Withdrawing Money Abroad

If anyone is good at making money with your money it is your bank. One way is to invest your money in financial products that are so complex nobody understands them, in some cases not even the bank itself. Another way is to charge fees whenever you access your money, for example when withdrawing cash in foreign countries. This article focuses on the latter and gives tips to minimize the amount of money disappearing in the bowels of financial institutions and some other tips to help manage your money abroad.

Divide and Conquer

Stuff gets stolen. Unfortunately this is a reality to keep in mind, even more so when traveling in foreign countries with all your valuables in easily accessible backpacks and suitcases. It is wise to mitigate the risk of ending up with no money in a foreign country where you don't know anyone and don't speak the language. One way of doing this is by bringing multiple credit- and debit cards. Traveler's cheques are also an option and still accepted in many popular tourist destinations but with an ATM on every corner in the world they are becoming increasingly rare. Make sure to store your cards and cheques in different places because if you keep everything in one wallet and that wallet gets lost you end up in the same place you want to avoid at all cost: without money.

As backup it can be helpful to also have some US dollars in cash because dollars are accepted almost anywhere, so this is the best currency to have in case of emergency or whenever there is no (electronic) way to get access to money. Another reason to bring dollars is that many countries require payment in dollars when applying for visa.

My personal strategy is to have a debit card that I keep on me at all times and a credit card that is stored somewhere else. If I have to pay something with my credit card I will swap the cards so that they are still in separate locations. The weak link in all this is whenever I am actually traveling — as in moving from A to B — because then I will be carrying all my stuff with me. In this situation I still have the cards in different bags but if someone decides to rob me I have a problem.

If for some reason after taking the necessary precautions you end up losing everything look for signs of money transfer services like Western Union and MoneyGram to get access to cash. You will need the help of someone so hopefully you have friends or family willing to lend you money. If you have travel insurance give them a call, they might be able to help you as well.

Avoid Transaction Fees

In western countries most shops accept plastic — debit and credit cards — but in many other places around the world cash is still king. You might find some places that accept credit cards but you are likely to be the one paying for the transaction costs involved, typically a 3% surcharge. So, in order to avoid transaction fees it is best not to use your credit card but instead withdraw money from ATMs and pay cash.

ATMs are everywhere and generally the easiest and cheapest ways to get foreign money. However there may be costs involved in withdrawing money from a foreign ATM, both from your bank and the foreign bank. Therefore it can pay off to do some research before sticking your card in a machine as some banks charge less than others or even don't charge anything. For example, when I use my credit card my bank charges me a flat fee of € 4.50 and an additional 1.5% markup on the current exchange rate, but with my debit card I don't pay any fees except a 1.0% markup. It should be clear that I try to avoid using my credit card but sometimes I have to as it may be the only card an ATM accepts. Besides the fees charged by your own bank there can also be fees charged by the foreign bank; the ATM should inform you about this during the transaction. I have found the country pages on Wikitravel to be a good source for information about foreign ATMs and the fees they may charge.

With all these fees you can save money by withdrawing as much cash as possible in a single transaction, but personally I don't like carrying around large sums of cash. Others might be more comfortable with this and then it can be worth searching for ATMs with high or no limits on the amount that can be withdrawn.

If you are going to travel a long time or visit many different countries it might be worth looking at special cards specifically for this purpose. Most of these cards charge little or no fees when traveling abroad. Do a search for travel money card in your favourite search engine to find the best option for you.

Withdraw Stupid Amounts

This might sound stupid but you will thank me for this whenever you run into a traveler who is desperately trying to change his Thai' 1000 baht banknote to pay for his 30 baht Pad Thai.

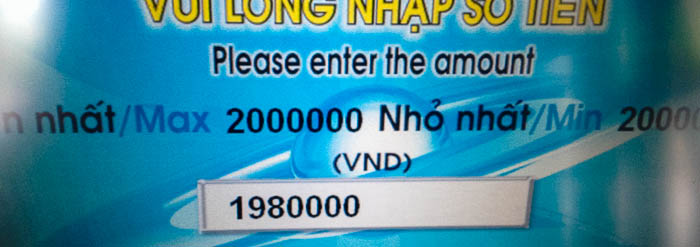

Most ATMs are configured to give you the smallest number of bills as possible: if you choose to withdraw 100 US dollar chances are high you will get one 100 dollar bill. If you this happens to you in Cambodia you might have trouble paying with this bill, so instead you could withdraw 80 dollars which would force the ATM to give you four 20 dollar bills. Similarly in Vietnam where I withdraw 1,980,000 dong instead of 2,000,000 dong to always have some small notes at hand.

If you still end up with large banknotes that nobody is willing to accept I have found that the best places to get rid of them are supermarkets and convenience stores. Alternatively you can spend it on a night in a fancy hotel or in an expensive restaurant